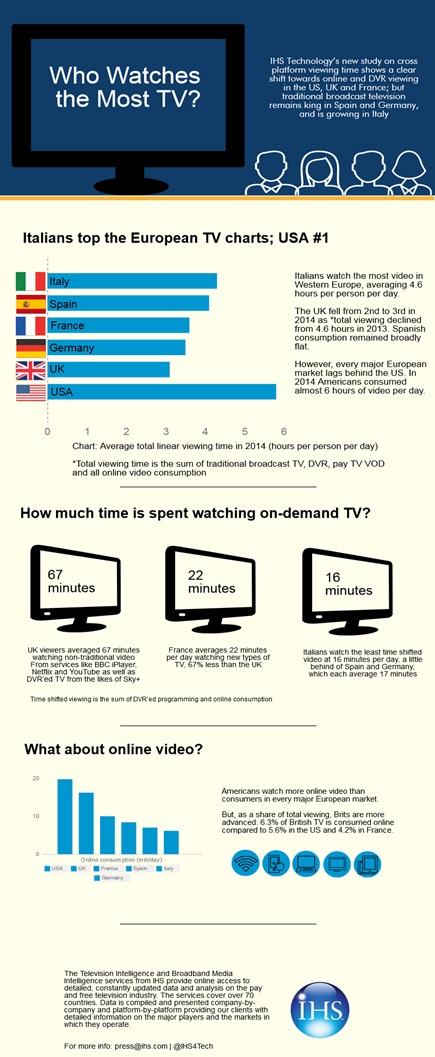

Brits are watching less TV than ever before, with average viewing time across all platforms falling by 14 minutes since 2013, according to new research.

The study, from HIS, looked at TV viewing times across the US, UK, France, Germany, Italy and Spain.

Key points:

• Italians spend about four hours and 20 minutes a day watching TV: that’s more than any other European country

• Brits are watching less TV than ever before, as the average viewing time across all platforms decreased by 14 minutes between 2013 and 2014

• Analogue cable and poor Internet lines in Germany meant that online and pay TV On Demand video has not grown as much in Germany as across other European countries

• Every major European market watches less TV than the USA; Americans average almost six hours of viewing per day.

European-wide trends

New research from IHS Technology indicates that traditional broadcast television viewing is being overtaken by two forces: Personal Video Recorders (PVRs) like Sky+ and online video from services like Netflix and BBC iPlayer. More time than ever before is being shifted from traditional broadcast television to online.

UK – Fast adopters of online viewing

In the UK, 2014 saw record lows for traditional TV viewing time, with the average Brit watching around three hours of TV each day, down 14 minutes from the year before. The growth in time-shifted viewing, or the sum of all recorded programming and online consumption, meant that Brits actually watched less TV in total in 2014 than in 2013.

“The UK was an early mover with high quality online catch-up services from local broadcasters like the BBC and Channel 4,” said Dan Cryan, senior director of media and content at IHS Technology. “This has now been joined with clever marketing initiatives like ‘digital box sets’ from Sky and the presence of the major platforms like Netflix and Amazon Prime.”

In 2005, under three minutes a day was spent watching recorded TV, but in 2014, Brits spent approximately 43 minutes a day watching recorded shows on services like Sky+ and YouView.

France – Online growing slowly

On average, the French watch about 216 minutes of broadcast TV per day, 10 minutes less than the year before, but well above the 2010 average. “The use of online services in France is growing, but not at the speed we are seeing in the UK,” Cryan said. Non-traditional viewing time increased by 17 percent, reaching 21 minutes per-person per-day in France. The largest increases came from pay TV operators’ video on demand services, which grew about 20 percent to seven minutes per-person per-day.

Netflix launched in France in the final quarter of 2014. The result of this late entrance and its full impact is not visible in the 2014 figures. “Pay TV operators in France are clearly concerned about the competition from Netflix, as we saw providers expanding their on-demand offerings with new features and services to combat the threat,” Cryan said.

Germany – Traditional broadcast holds strong

Germans watched 210 minutes of broadcast TV every day in 2014, an average that did not change from the year before, according IHS Technology. Pay TV subscriptions in Germany grew by 700,000 in 2014, continuing its seven year growth trend.

“When it comes to TV, German consumers prefer to pay for access rather than content, and as a result, traditional television channels that offer popular shows remain dominant in the German market,” said Daniel Sutton, analyst at IHS Technology.

The prominence of analogue cable in Germany has hindered the development of high volume True-Video on-Demand platforms. Some 55 percent of German pay TV subscribers are still limited to linear Video on-Demand (VoD) technologies such as nVoD or Live Pay Per View. VoD Deutsche Telekom and Unitymedia launched VoD services in 2006, and while these were initially slow to grow, they now reach 47 percent of the total pay TV market.

Italy – Leaders of Europe TV time

Unlike the rest of Europe, Italians actually increased their average daily consumption of broadcast TV in 2014. Following a steep fall in 2007, traditional TV viewing grew by an average of four minutes and 42 seconds per-person per-day between 2008 and 2014 to reach four hours and 20 minutes. If we include online and pay tv viewing figures, the number of hours spent watching video in Italy rises to four hours and 37 minutes per day.

“Continued growth of viewing, in particular linear, can be attributed to Italy’s difficult financial situation, with high unemployment correlating to an increase in TV viewing time on a per-person per-day basis,” Cryan said.

Online viewing times are very low compared to the other countries in the study. “Despite investment, we are not seeing the kind of pick up or adoption in other European countries,” Cryan said.

Spain – Holding steady

The Spanish watched on average 242 minutes of TV per day, a slight drop from 2013’s figure. Online video viewing increased by 24 percent, reaching eight minutes per person, per day. At roughly 11 percent of total non-linear viewing time, online long-form video has developed more in Spain then its fellow Mediterranean market Italy in terms of viewing.

USA – A quiet revolution

Americans watched an average of 351 minutes of TV per day, the equivalent of almost six hours, in 2014

“Americans use TV differently to many other parts of the world,” Cryan said. “While Europeans will put on the radio for background noise, Americans will turn on the TV. This helps to explain why American linear TV viewing is remains higher than economically challenged Italy.”

Traditional TV has an entrenched role in American lives, but that position is being chipped away by alternative content and consumption models. “We are seeing a quiet revolution in the way that Americans watch video,” Cryan said.

The decline in linear TV has been more or less offset by the growth of other forms of viewing. Online long-form programming from the likes of Netflix, Amazon Prime and Twitch grew 24 percent per person at a national level in 2014, although the consumption growth from the users of online services is frequently much higher than this.

View the full infographic from IHS below:

Source: www.ihs.com