The latest Advertising Association/WARC Expenditure Report gave UK adspend an upward revision from the 15.2% rise forecast in April and includes an estimated 54.7% rise during the second quarter of the year.

This growth will recover the entirety of 2020’s £1.8bn decline and is expected to precede a 7.7% rise in 2022, by when the market will be worth a record £30bn, the report says.

The projected figure of 18.2% growth this year would be the largest rise on record, surpassing the previous high of 15.9% growth set in 1988.

Other forecasts from WARC also suggest the UK is on course to achieve the fastest ad trade recovery of any major European market this year, and one of the strongest growth rates across 100 global markets.

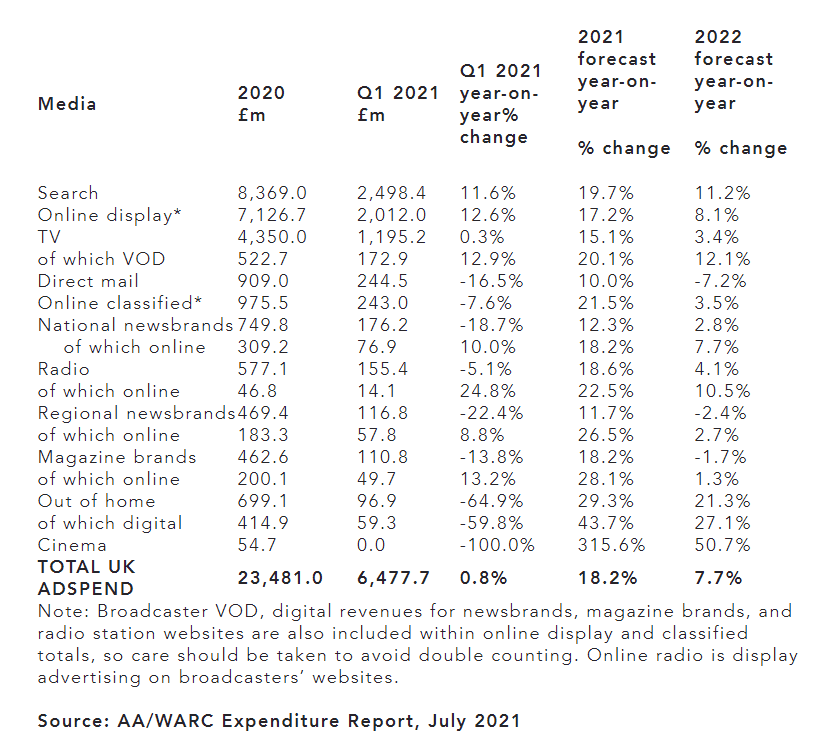

TV adspend is expected to increase by 15.1% in 2021 (a significant upward projection from the 8.8% forecast in April), reflective of increased activity during the Euros.

Media most adversely hit by the pandemic are set to bounce back strongest, such as cinema at +315.6%, out-of-home at +29.3%, of which digital OOH at +43.7%. Online classified investment is set to rise by a fifth (21.5%).

Online display, which includes social media and online video – is set to see faster growth this year (+17.2%), as is the case for search (+19.7%).

During the first quarter, online formats – most notably search, online display and Broadcaster VOD – grew by double-digits during the quarter. Out-of-home spend was down by almost two thirds and cinemas remained closed as the UK adhered to lockdown and social distancing restrictions.

Sectors that also saw year-on-year decline in Q1 were direct mail (-16.5%), national newsbrands (-18.7%) and regional newsbrands (-22.4%).

Stephen Woodford, CEO of the Advertising Association, said:“These are hugely encouraging figures for the UK advertising industry and reflect the strong outlook in the wider economy.”

He added: “The UK is the global hub for advertising and will also benefit from faster growth in major export markets for UK advertising services. If the AA/WARC expenditure estimates turn out as forecast, then the ad industry will contribute strongly to the nation’s economic resurgence this year and into next.”

Industry comment

Nicole Lonsdale, Chief Client Officer, Kinetic UK, said: “AA/WARC further proves that UK audiences have taken to the outdoors in record numbers. According to our recent Alfresco Life research (Kinetic’s study into consumer behaviour), OOH weekly reach is at 96% – back to pre-covid levels – reaching around 31 million adults each day. In addition, the commute is back for many of the working population, with reach on Transport expected to be at pre-covid levels by September. The reported rise in investment suggests advertisers are ready to take advantage of the surge in mood and mobility, with the market buoyant well into 2022.

“Moreover, through the evolution of automated trading and dynamic creatives, advertisers are able to pinpoint audiences through useful data and respond with tailored messages in near real time. OOH’s smart targeting capabilities can ensure that advertisers have robust plans in place, with the speed, agility, and flexibility, to meet audiences wherever they may be. This will prove a critical factor in Q4 and the lead up to Christmas.”

“It is encouraging to see that the UK advertising industry continues to grow in the face of uncertainty; even more so to see the promise of expected growth in media such as out of home. As the vaccination programme continues to rollout, we find ourselves in a social awakening where people are enjoying long lost freedoms once again. This resurgence of social interaction is something we have seen amongst 18-24 year olds with our recent research revealing 63% of students are keen to get out more and socialise. As we leave behind what we hope will be the end of the COVID-19 restrictions, we are optimistic that OOH will see a positive uplift as we move through Q3 and into Q4.”

James Lane, MD, Redbus Media, said: “The AA/WARC advertising expenditure report paints an incredibly positive picture for the future of advertising following some truly challenging times in our industry. With ad spend expected to grow in the UK by 18.2% this year, we are clearly on the path to recovery from the negative impact we saw from COVID and lockdown on almost all forms of media. Alongside this growth in ad spend, marketers should also be set to benefit from pent-up consumer demand, and through refined media strategies, be in line to deliver a stronger ROI than ever before from their advertising as a result. With digital media in particular, brands and agencies have a unique opportunity to innovate and capitalise on some of the changes that have happened in consumer behaviour over the past 12-18 months; whilst demonstrating to consumers that they understand how and when they should target them in this new post-covid era.

Emma Lacey, Senior Director, Buyer Development at OpenX, said: “Much like the UK’s confidence-boosting coronavirus vaccine roll out, these encouraging quarterly results – and a more promisingly upwardly revised forecast for the remainder of 2021 – represent a much needed shot in the arm for the market. There are high expectations for a return to ‘business as (close to) usual’ for many advertisers, as they look to regain share or drive awareness back to pre-pandemic levels.

Craig Tuck, Cheif Revenue Officer, The Ozone Project, said: “Despite this renewed vigour, some caution remains across the market, with digital investment having to work harder than ever to justify its place on a plan, representing a great opportunity for quality media environments, proven to deliver. At Ozone, we continue to see significant growth in digital investment in our platform, a trend also reflected by many of our individual publishers, such as Reach who recently announced digital revenues are up 43% for the first half of 2021. This fantastic growth further underlines the value advertisers place in reaching high attention audiences who, according to Ofcom’s latest News consumption in the UK report, continue to have high levels of trust in the content they read across our publishers, all within brand safe, premium environments like those delivered at scale by the Ozone platform.”

Stan Pavlovsky, CEO at Shutterstock, said: “Advertising is a vital engine for growth, and the latest forecasts from the AA/WARC report are hugely encouraging for the industry. However, what is currently not being addressed, and remains a challenge, is the ability to discover and select the right content that is relevant, and ultimately that resonates with audiences. We’ve heard this challenge first-hand from our partners across discipline and focus areas. With the latest announcement of Shutterstock.AI, as well as the acquisitions of three AI platforms, we aim to support creatives and media organizations by unlocking a whole new world of creative predictive performance powered by AI. It’s essential that while ad spend is on the rise, businesses have the ability to swiftly discover and select content in order to create with complete confidence, ensuring that spend is used wisely, and generates the desired impact.”

Emma Lacey, Senior Director, Buyer Development at OpenX, said: “The AA/WARC advertising expenditure report paints an incredibly positive picture for the future of advertising following some truly challenging times in our industry. With ad spend expected to grow in the UK by 18.2% this year, we are clearly on the path to recovery from the negative impact we saw from COVID and lockdown on almost all forms of media. Alongside this growth in ad spend, marketers should also be set to benefit from pent-up consumer demand, and through refined media strategies, be in line to deliver a stronger ROI than ever before from their advertising as a result. With digital media in particular, brands and agencies have a unique opportunity to innovate and capitalise on some of the changes that have happened in consumer behaviour over the past 12-18 months; whilst demonstrating to consumers that they understand how and when they should target them in this new post-covid era.”

Andy Ashley, International Marketing Director, Digital Element, said: “With the news that ad spend is growing at the fastest rate on record, the AA/Warc report will be sending confidence soaring in the industry. However, the stats are also very revealing of the trends we can expect to prevail as the country becomes accustomed to post-lockdown life – trends marketers must keep top of mind to cement long term success.

“With the pandemic driving UK marketers to spend 70p in every £1 of advertising investment on digital formats, strategy around how to make the most of digital marketing efforts is key – especially with the added complication of consumers now interacting more outside of their homes. Data and tools that link the online and offline worlds, to enable marketers to deliver consistently seamless experiences, even as consumer habits change, are vital. By connecting digital and physical touchpoints through information such as location, connection type and device type, marketers can continue to deliver the most relevant messaging in the moment, making their marketing pounds work harder and more effectively.”

Bill Swanson, EMEA Strategy Lead, IRIS.TV, said: “The report findings are exactly what the industry needs to maintain momentum as we speed past Freedom Day towards something like normalcy. To stay on this growth trajectory and reach the connected consumer who’s device usage is ever more fragmented, marketers need to think granularly about where the eyeballs are shifting and tailor their targeting strategies.

“For instance, CTV is pulling budgets away from more traditional linear TV and digital to meet the needs of a consumer that has become accustomed to watching what they want when they want – a prime example being the Tokyo Olympic Games, with tricky live broadcast times prompting increased viewers watching on demand.”

Lucy Hinton, Head of Client Operations, Flashtalking, said: “The latest figures highlight both the robust nature of the UK ad industry – with the fastest predicted recovery of the major European markets – and how digital advertising has played a big part in this. This is perhaps no surprise considering how consumers have moved online in increasing numbers during the pandemic; however digital also offers advertisers the ability to be flexible in uncertain times, and reach new audiences across an ever-expanding array of platforms and devices.

“Marketers need to take the lessons they have learned and apply them to an even greater extent moving through 2021. With consumers keeping hold of some of their digital habits, but also becoming more mobile, brands must become more agile to grab their attention, and use their resurgent ad budgets wisely. Now, more than ever, having premium ad formats with strong creative, and backed by genuine data insights will be key for those who want to stand out from the crowd.”

Alys Donnelly, Head of Programmatic, Kinetic Worldwide, said: “The outlook for 2021 is positive across the board, but it is especially promising for channels that were negatively impacted by restrictions on movement over the last year and a half. The shining star for 2021 looks to be digital OOH (DOOH), which is forecast to grow an impressive 43.7%.”

“It’s natural advertising spend follows consumer behaviour changes, but this alone doesn’t account for the shift to DOOH. While we’ve been stuck indoors the channel has been evolving programmatic capabilities, from data-driven planning and optimisation to streamlined buying of inventory, which means DOOH is more flexible and better placed than ever to meet custom KPIs for clients. And these ongoing technological advancements are only likely to propel even more ad spend out of home and into sight over the coming years.”

Leigh Gammons, EMEA CEO of Wunderman Thompson Technology, said: “These positive findings show that there is clearly increased customer spending activity, and that online and digital channels continue to dominate now that the pandemic restrictions have been relaxed. During the pandemic, the restrictions accelerated the shift to online advertising as brands sought to engage with customers who were stuck at home. But even as customers now begin to shop in-store again, online activity continues increase as brands are waking up to the value of linking in-store and online customer engagement.

“ By doing this, businesses can provide the best service for their customers by delivering a personalised and consistent digital experience while also recovering from the impact of the pandemic. To ensure success as we move through 2021, brands need to be able to take the online relationship they have built with customers over the past 18 months and seamlessly connect this to engagement in-store.”