Companies with the strongest revenue growth let insights and analytics lead the business to a far greater extent than ‘underperformers’, according to new research.

The Insights2020 study from study, from Millward Brown reveals the top drivers of customer-centricity, and proves there is a link between strong customer focus and revenue growth.

The study also found that UK businesses are better equipped than companies in other markets to use customer insights to drive growth.

Companies in the UK are also supported more strongly than those in other countries by leadership who make customer-centricity a top business priority. They lag behind their peers in other markets in the use of insights and analytics to create a total customer experience, however.

The study also found that the businesses which outperform competitors in terms of revenue growth also show the highest level of customer-centricity (overperformers), while those with the lowest revenue growth show the lowest level of customer-centricity (underperformers).

The Insights2020 study was led by Millward Brown Vermeer in partnership with the Market Research Society (MRS) in the UK, as well as The Advertising Research Foundation (ARF), ESOMAR, LinkedIn, Kantar and Korn Ferry. It involved 340 in-depth qualitative interviews with senior marketing and insights leaders, and quantitative survey responses from 10,500 practitioners in 60 markets. Insights2020 builds on the Marketing2020 study, which explored how global CMOs align marketing strategy, structure, and capability with business growth.

The factor that makes the biggest difference to customer-centricity is ‘customer obsession’. 79% of overperformers reported that a customer-centric culture is embraced by all functions, compared with only 13% of underperformers. 37% of UK businesses achieve this level of customer focus, just above the overall global figure of 36%.

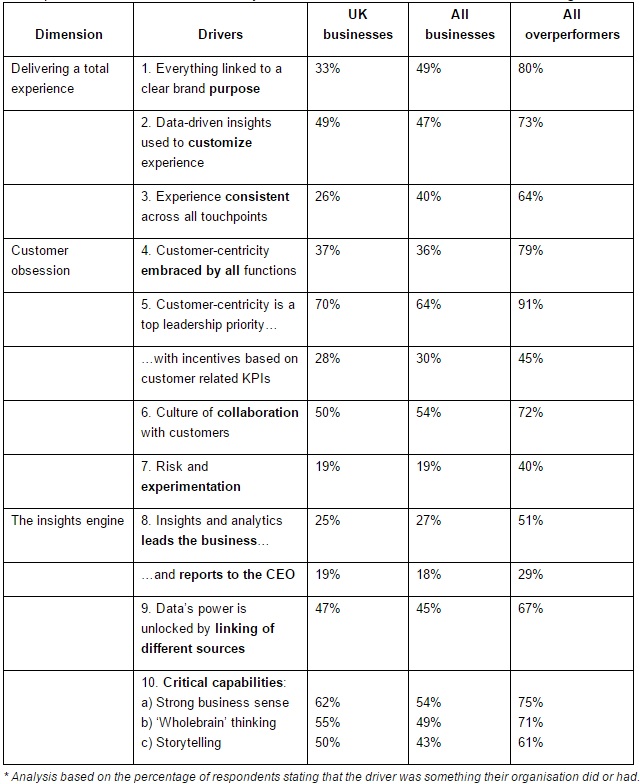

The study found that strong brand purpose is also critical for overperformers, with 80% rooting all activity in a clear purpose, compared with only 32% of underperformers. Only 33% of UK businesses do this; lower than the global figure of 49%. In terms of creating a consistent 360° experience across all touchpoints, only 26% of UK businesses do this, compared to 40% of all businesses surveyed and 64% of overperformers.

More UK businesses (56%) have the critical insights capabilities needed to drive customer-centric growth than the global average (49%), and have customer-centricity as a leadership priority (70% compared with 64% across all businesses surveyed).

Amanda Phillips, Millward Brown’s head of UK Marketing, said: “We know more about our customers than we ever have – where they shop, how they dress, why they smile at an ad and pass it on to their best friend. It’s a privilege that customers open a door into their world this way. The winning companies of tomorrow instinctively get this and so they obsess about how they can change themselves for the better.”

The top 10 drivers of customer-centricity – those drivers that contribute most to business growth – were revealed as*:

Jane Frost, CEO of the Market Research Society (MRS) and UK partner of the study commented: “Insights and analytics (I&A) is evolving from a function that answers specific marketing questions to being a valued co-pilot for the whole organisation to use in decision-making. The UK’s I&A teams are in a good position to maximise their impact and take a more leading role. They have a solid sense of the business, the analytical skills to make sense of data and the ability to translate it into actions and recommendations, bringing it to life in a way that compels people to do things differently.”

Other global highlights of the findings from Insights2020 include:

· China leads the world in delivering a 360° customer experience, and having a ‘customer obsession’: Of all the key markets surveyed, businesses from China scored most highly on being purpose-led, as well as creating a customised, consistent customer experience. They also scored highest on customer-centricity being embraced by all functions.

· FMCG and technology are the highest-performing sectors: Among the industry sectors surveyed, FMCG businesses perform most highly in the ‘total experience’ dimension, while the technology sector leads on both the ‘customer obsession’ and ‘insights engine’ drivers.

· The top four challenges involved in becoming more customer-centric, according to participants in the study, are: ‘Internal silos and bureaucracy’; ‘Legacy of structure and functions that are not designed to deal with the opportunities of today’; ‘Making sense of all available data’ and ‘Recruiting wholebrain people’.

Millward Brown Vermeer has used the results of the survey to create a scorecard that any organisation can use to quantify the potential revenue improvement it can gain from becoming more customer-centric. The scorecard enables the business to assess its current maturity against each of the top 10 drivers of customer-centricity, and calculate the monetary impact of improving performance in each area.

Phase two of Insights2020, the results of which will be available in early 2016, will build on the key drivers of customer-centric growth identified in the first phase, and explore a roadmap for helping brands to achieve customer-centricity.

Source: www.millwardbrown.com