Covid-19 has many long-term consequences for how industries work. The ecommerce revolution has been brought forward by five years as locked down shoppers move online for even the most basic goods, from foods to fashion.

As fashion online retailer ASOS buys the international fashion chain stores TopShop and Miss Selfridge, a new structure for the fashion industry is emerging. A few weeks before, Boohoo snapped up the Danish and UK department store Debenhams, before buying other Arcadia brands Dorothy Perkins, Wallis and Burton. All these deals dispensed with the high street businesses, taking the brands and their customer bases online-only.

The ASOS deal was a tipping point on a whole culture of clothes shopping – a prelude to nights out, Saturday afternoon coffees in town centres, changing room debacles and lugging shopping bags home like trophies.

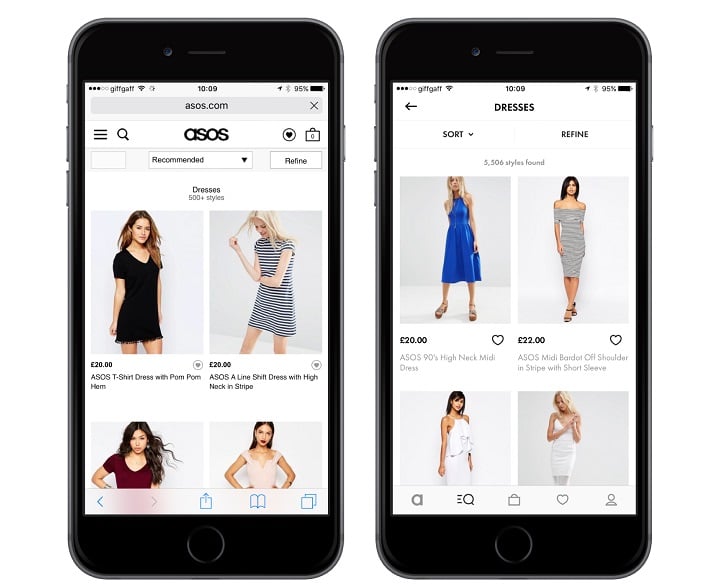

Increasingly, buying clothes is becoming an activity to be done on a laptop or a phone, and lockdown has accelerated a generational shift which was already in motion.

The fashion brands with which Generation Z connect, such as Boohoo and Missguided, have built their communities online, without investment in physical stores.

Key factors

There have been several key enablers to the seismic shift in fashion:

- New mindset for online ordering among consumers, both removal of the perceived barriers and pull factors of increased demand

- Generous returns policy from fast-fashion brands like ASOS that remove the risk of ordering something that doesn’t fit

- Falling delivery costs for the last mile as distribution companies gain the economies of scale to make it viable

- Advances in automation of picking and packing reduced costs in developed countries

In contrast, the fashion retailers in malls and high streets around the world have been under greater pressure than most: categorised as non-essential, closed during lockdown, closed in many countries and in economies in recession, fashion is notoriously volatile to falls in consumer confidence.

High street collapse: Case study of the UK

The country that invented department stores has been one of the clearest hit by the global pandemic. A wide variety of clothing retailers couldn’t sustain their business during lockdowns.

In spite of state-funded compensation for staff who couldn’t work, the business models of the retailers couldn’t make it. UK-based brands that declared profit warnings or started looking for buyers included BrightHouse, Oak Furnitureland, Hawkin’s Bazaar, Bonmarche, Jaeger, Le Pain Quotidien and Monsoon. The trend was echoed worldwide, with retailers such as J-Crew, L’Occitane and JC Penney hitting financial trouble during the pandemic in the US.

Back in June 2020, Boohoo also agreed to buy the online businesses of Oasis and Warehouse for £5.25m.

Online phoenix: Asos & Boohoo

Retailers with brilliant ecommerce strategies managed to grow sales during the toughest moments of lockdown. The online pureplays, such as ASOS and Boohoo, were especially strong.

Boohoo saw UK sales jump 40% to £357.2m in the four months to December 31, 2020. ASOS saw sales soar 23% to £1.3bn in same time period, with a 36% rise in UK sales.

There are a host of factors that have contributed to the online fashion shopping boom during the pandemic. Firstly, digital businesses have benefited from much of the high street being closed currently and for parts of 2020. Pureplays had a tailwind from physical clothing stores being closed during November. Consumers who do want to shop for fashion can only do so online or in a supermarket.

Adaptation to rapidly changing customer needs is also key. This is something the fast fashion businesses, like Boohoo and ASOS can adapt to quickly. Many online only, and multichannel retailers, have pivoted successfully towards more casualwear, athleisure and knitwear. Boohoo says popular product categories during the pandemic have included loungewear and shackets (a shirt/jacket combination).

Those more casual sectors have been in demand as numerous people continue to work from home, and workout at home. Zoom video calls only show so much of your outfit, so bosses won’t realise if you are wearing smart shoes or slippers.

But less social events, for some, may mean they have more disposable income. Not spending in pubs and restaurants, for example, could leave some with more money to spend on fast fashion.

Around the world there’s a similar pattern, such as Chinese sportswear brand Li Ning, which cooperated with Alibaba to undergo a radical digital transformation, raising its share price during the pandemic. Meanwhile shares in Zalando, Europe’s biggest online-only fashion retailer, jumped 11% to a new record high after it said it expects full-year sales growth of 10-20%.

Trend or one-off?

“This is a shift in the business models of fashion retailers”, explains Danny Meadows-Klue, CEO of the Digital Strategy group and previously the manager of one of the UK’s first ecommerce businesses. “The high street and mall footprint is the biggest cost item on those company balance sheets. If new owners can make 50% of those sales online with 5% of the costs, it’s a game changer for the brand”, said Meadows-Klue. He sees ‘fast fashion’ groups like ASOS and Boohoo as simply benefiting from economies of scale in the same way the traditional high street groups of businesses did generations before. “Their business models are proven, their technology and supply chains are digitally native, and their AI and insights can predict demand which gives a competitive edge. It’s certain there will be massive technical advantages of consolidating new acquisitions onto the state-of-the-art tech platforms and processes digitally native businesses have built”.

What fills the thousands of empty shops left behind is far less certain. With the role of high street and mall fashion, food and department stores all changing, the economics of retail have shifted. “There will still be a business model for high street retail, just a very different one”, says Meadows-Klue, citing several examples of how the physical footprint of stores can continue to be viable. “Those who are successful on the high street after lockdowns will be doing so by appealing to different markets: the smaller group of those who don’t buy online, those who want the experience of shopping (look out for much bigger brand experiential marketing events), the big ticket clothing items that take more consideration, and the luxury sector”.

If changes in demand for retail happen at scale, then the economics of how the retail real estate sector works will also change. What’s needed to make the malls, the high streets, and the central business districts of the future thrive looks likely to be very different from what made them a success in the past.

Why this matters

The UK has been a “laboratory market” for ecommerce, with the first national grocery stores launching online 25 years ago. It’s a market where digital trends often start, so you can use it to predict what may happen in other places.