The companies, which have a joint market value of more than $5trn (£3.8trn), are facing threats of further regulation in the US, with conservative politicians claiming the firms are biased against them.

Democrats are also critical of the tech giants, claiming they use their power and monopoly to silence smaller businesses who may pose a threat.

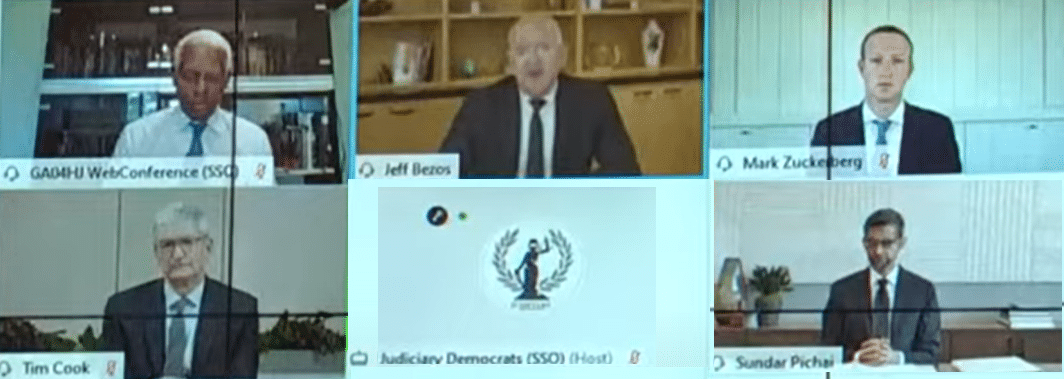

View some key highlights from the hearing below:

Google silencing rivals like Yelp?

David Cicilline, a Democrat representative on the House Judiciary Committee’s antitrust panel, opened the hearing saying: “Simply put, they have too much power.”

He went on to ask Sundar Pichai, the head of Alphabet, Google’s owner: “Why does Google steal content from honest businesses?”

Cicilline accused the company of attempting to silence Yelp by de-listing it from its search results if it failed to allow it to take reviews from the site.

Pichai disagreed that Google would steal content from other firms, adding that it conducts itself to the “highest standards”.

Google also came under attack from Republican Jim Jordan, who claimed the firm could skew its search results to support Joe Biden’s presidential campaign, which Pichai denied.

Instagram’s Trump Jr. ban

Facebook’s Mark Zuckerberg was criticised by representatives over his company’s purchase of Instagram in 2012 – an acquisition they suggested was prompted by fears that the photo-sharing app could pose a threat to Facebook.

The tech entrepreneur disagreed that was the reason for the purchase, saying: “It was clear that this was a space that we were going to compete in one way or another. I don’t view those conversations as a threat in any way.”

Zuckerberg was also asked about the temporary removal of Donald Trump Jr from Twitter this week, over a video about the efficacy of hydroxychloroquine in treating coronavirus.

He appeared to stand in solidarity with the micro-blogging platform, suggesting Facebook would have also removed the content.

Apple’s treatment of third party developers under scrutiny

Apple was challenged over its treatment of third-party app developers and accused of changing the rules to benefit the organisation at their expense.

Tim Cook, the head of Apple, said that all developers are treated the same way, and batted away claims that the firm could increase its cut of app sales by saying the developer market is competitive, and designers could move away to other platforms if costs went up.

Amazon running smaller firms out of business?

Meanwhile, Amazon’s Jeff Bezos was making his first appearance in front of House politicians and was asked about claims his company ran smaller ones into the ground.

Cicilline said that companies that use Amazon as a marketplace have likened getting their payment from the firm as a “drug”, in that it feels good initially, but before long they are run out of business when the shopping giant launches rival products.

“Mr Bezos, this is one of your partners. Why on earth would they compare your company to a drug dealer?” the representative asked.

Bezos replied: “I completely disagree with that characterisation.”

The richest man in the world also avoided directly answering a question as to whether his company used seller data to make business decisions, saying that the answer was not simple.

The Huawei factor

The quartet also made comments about the increasing dominance of Chinese technology, and Huawei in particular.

The committee the men appeared at is close to making recommendations in a report that will outline what can be done to tame the power of big tech in the US, after trawling through around 1.3 million documents to come to a conclusion.

Industry comment

Tal Chalozin, Co-Founder & CTO of Innovid, said: “Clearly the biggest item for today’s earnings is the CEOs testifying in front of the US Congress yesterday. Since advertising is the core revenue for Alphabet and Facebook, and a massively rapid growth vehicle for Amazon – it took a big part of the competitive inquiries. I don’t believe that — based on the discussions at the US Congress yesterday — any specific items came up that may impact the value or strategic belief of any of these four tech companies.

“My prediction is that Q2’s shelter-in-place had a major impact on the ad business of those companies. I think that it will create tail winds for Amazon’s ad business, most notably given the Fire TV business. The platform showed the massive power it has when the two biggest launches in the TV business (Peacock and HBO Max) did not make it to Fire TV due to the debate on fees, and the strength of the Fire audience.

“I predict that YouTube will show a big downward impact on the early side of the quarter because it was one of the easiest platforms to rapidly pause. That said, I think that during the quarter, there has been a bounce back that may have a positive impact on Alphabet’s report. Facebook battled with north of 1100 advertisers pulling away their spend. However, my prediction is that there will be a marginal impact on the Q2 number.

“It’s safe to assume that connected television (CTV) will be a big part in Alphabet and Amazon’s reports, given the growing demand during this time. With Fire, Amazon is ahead of the other three in market share and in television operating systems. But I think that Alphabet is working hard and will soon release (either during Q3 or Q4) a big play on that market that may boost their adoption.

“I don’t believe the area of data and identity will play a role in second quarter earnings, even though it’s a core element to the anti-trust discussions that cut across all four companies. At this point, I think that Q2 reports and questions will center on the global pandemic and its impact on ad spend. Amazon will lead the charge to show a strong quarter on that front, given the commerce platform. Alphabet will show good signs of recovery with YouTube, and Facebook will show real impact of the trying times in their report (even though, as stated above, I think the boycott impact will be much lower than expected)”

View the full hearing below: