The findings from the Advertising Association/WARC Expenditure Report reflect a slight upgrade on earlier forecasts.

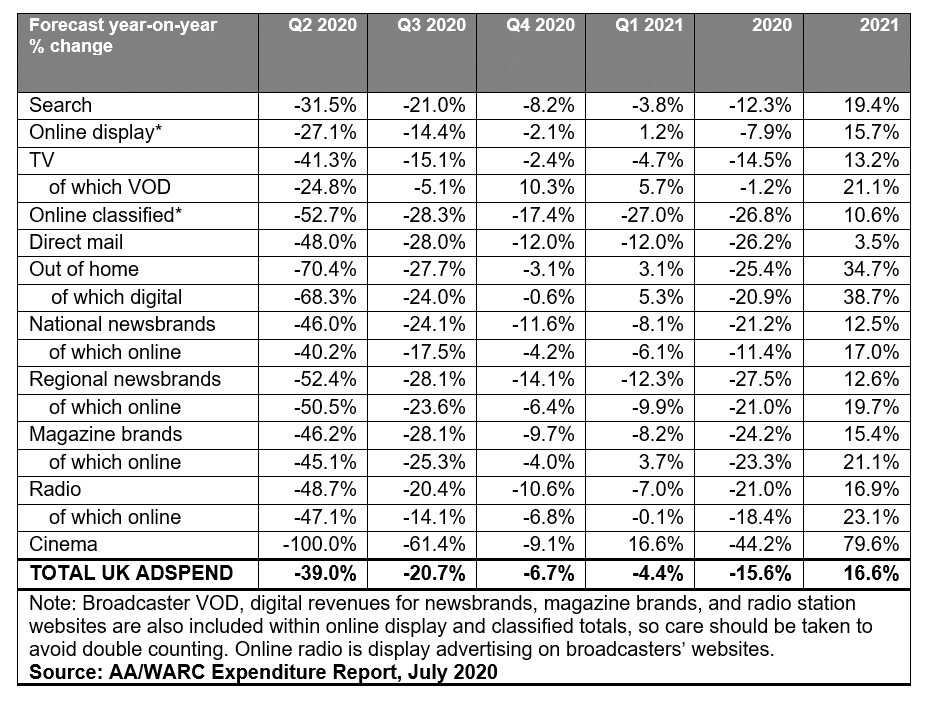

UK adspend rose 2.9% year-on-year in the first quarter of 2020, but the report points to an estimated 39% slump in the second quarter as the impact of the COVID-19 crisis was felt across the industry.While the third quarter is expected to see relative improvement at -20.7%, it’s not until Q4 that some sort of normality returns and even then spending is still forecast to be 6.7% down on the same period in 2019.

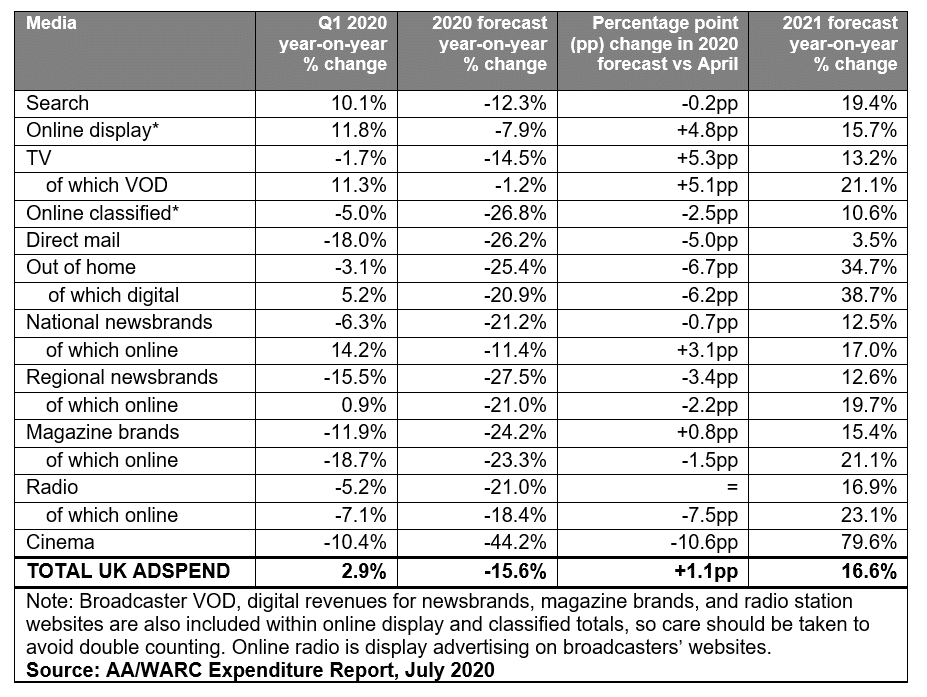

Overall, UK adspend is predicted to fall 15.6% – £3.9bn – year-on-year in 2020 to £21.4bn. This is a slight improvement on the drop of 16.7% forecast in April, linked to the estimated impact of recent measures announced by the Government to stimulate consumer spending.

“First quarter metrics were softer than had been anticipated going into lockdown, but we believe the second quarter will represent the nadir,” says James McDonald, Head of Data Content, WARC.

“With unemployment expected to remain well above pre-pandemic levels into next year, and the possibility of a second virus wave during the winter, no growth in total adspend is forecast until Q2 2021.

“Our cautious optimism that investment will rebound from April 2021 is rooted, in part, in a belief that a ‘new normal’ will then have been established, borne by a successful vaccination programme. Under these circumstances, we feel the UK’s ad industry can attain a full recovery during 2021 as a whole, though total market value will still be down on 2019’s peak.”

Online and digital formats performed strongly in Q1 2020: search and online display grew by 10.1% and 11.8% respectively, while broadcaster video on demand (BVOD) recorded growth of 11.3% and online national newsbrands saw a rise of 14.2%.

However, these are all expected to see a significant fall in Q2 2020 due to the impact of the pandemic and the consequent lockdown. The biggest falls are predicted to be for cinema with a 100% decline and out of home with a 70.4% decline. These media are both forecast to record some of the largest gains in 2021, with digital out of home (DOOH) seeing a rise of 38.7% and cinema witnessing the highest increase of all formats at 79.6%.

The stark figures reinforce the Advertising Association’s call for a tax incentive scheme for advertising and marketing services, with the aim of stimulating investment and encouraging advertisers to continue, or return to, advertising. Such a plan would also encourage companies that do not currently advertise, typically SMEs, to invest in advertising and act as a stimulus for the wider economy.

There’s also a need for “a regulatory environment that is open and fair, to ensure businesses have the confidence to invest”, adds Stephen Woodford, Chief Executive, Advertising Association. “This means avoiding increased rules and regulations, such as those proposed for HFSS advertising, that will weigh on the much-anticipated recovery we hope to see next year.”

Industry reaction

Vihan Sharma, Managing Director LiveRamp Europe commented: “While it is reassuring to see that ad budgets are expected to rebound to predicted levels in 2021, inarguably ad budgets will continue to be under increased pressure and scrutiny for the foreseeable future amidst the backdrop of an economic downturn and global pandemic. It’s more important than ever therefore, that advertisers prioritise addressable media across web, mobile in-app and TV, to name a few, to ensure every dollar spent is measurable and accountable.

“Brands need to ensure they are spending budgets in the most effective way possible at this time. Working with partners that empower addressable media spend can help them to accurately measure return on investment and test creative in-market.

“Advertisers also need to be mindful of industry shifts such as the disappearance of third-party cookies, and increasing regulations of device-based identifiers like mobile advertising identifiers (e.g., Apple’s IDFA). When advertising budgets do rebound, it will be vital that advertisers, platforms and publishers have partnerships and solutions in place that persist well beyond these significant industry headwinds, while protecting consumer privacy, transparency and trust above all. This will be crucial in ensuring business continuity.”

Justin Taylor, UK MD at Teads comments: “The latest AA/WARC expenditure report further demonstrates the devastating socio-economic impact Covid-19 has had on the advertising ecosystem. However, we must look for those glimmers of hope and to recovery. The slight improvement from the previous forecast is a small step in the right direction and credit has to be given to all of those who have worked tirelessly to keep businesses going and ensuring people remain in employment.

“Government initiatives such as ‘eat out to help out’, will no doubt attribute to the slight uplift which is expected over the summer months for some verticals. And if the tax incentive scheme for advertising and marketing services takes off, it will hopefully encourage businesses to continue advertising their way through this.

“However, what is evident from this report is, as an industry, we have a long winter ahead, with pre-Covid-19 ad spend levels not expected to bounce back until 2022. For this to happen, there must be a renewed focus on responsible advertising strategies which harness the power and agility of quality digital environments.”

Paps Shaikh, Commercial Director EMEA of Nextdoor comments: “The recent AA/WARC expenditure forecast makes for sobering reading, with pre-Covid-19 ad spend levels not expected to pick up again until 2022. Under these challenging circumstances, creative approaches to marketing must be taken. The tax incentive scheme will only go so far to encourage businesses to continue advertising but will be welcome. With cinema and out of home predicted to see massive declines in ad spend, I believe we will see investment from businesses, big and small, move to online community networks where consumers are increasingly spending their time.

“This return to local advertising or hyperlocal will continue to gain momentum as we experience specific lockdowns when (if) the second wave hits. Consumers want to be communicated to in a contextually relevant way amidst the background of Covid-19 and this is where the opportunities lie. Honesty and trust should, and will, play a big part in brand strategy going forward and online local platforms will be the channel in which to do this as consumers head online to support one another and make a difference offline.”