Data from the IPA Bellwether Report for the first quarter of 2020, which was compiled between 2 and 27 March, shows a net balance of -6.1% of companies revised their total marketing budgets lower.

This is a notable swing from the final quarter of 2019, where the net balance stood at 4%. In March, 25% of panel members recorded a budget cut and 18.9% signalled growth.

The fall marks the worst reduction since the global financial crisis in 2009. Adspend is forecast to shrink in 2020, before a recovery next year. A net balance of +16.2% of respondents expected higher spending over the next 12 months.

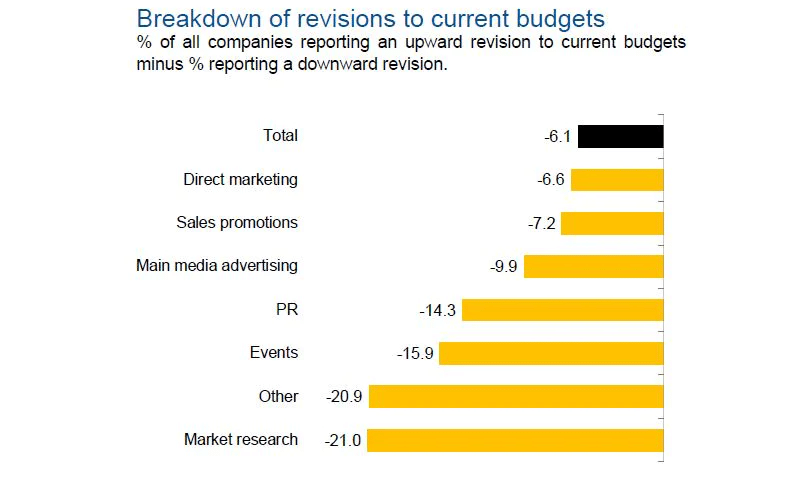

Market research was the worst-performing category of the survey in the first quarter with a net balance of 21% revising their budgets down, followed by events (-15.9%) and public relations (-14.3%). All sectors were down roughly 10%.

No type of marketing budget saw growth, with direct marketing and sales promotions observing the slowest reductions (net balances of -6.6% and -7.2% respectively).

The key brand-building category, ‘main media’, recorded its strongest downward revision since 2009 (net balance of -9.9%).

IPA director general Paul Bainsfair sais: “These are undoubtedly the toughest overall trading times that any business and indeed any marketer will have ever experienced, but while we suspect the fuller, sharper extent of this global pandemic to be captured in Q2 data, the hope from this report is that we will see a more upbeat end to the year.”

“Firms are in survival mode, reallocating funds to service liabilities and keep the business alive,” said Joe Hayes, economist at IHS Markit and author of the report.

“This is critical to ensure that they can keep staff on the payroll, which will give their businesses the best chance to recover when the time comes. It will also support the economy on a broader scale if people remain employed and are earning, as they will be in the position to go out and spend when the lockdown is over.”

Industry reaction

Jon Burton, Marketing Director, John West, said: “It’s hardly surprising that marketing budgets have taken a significant downturn as businesses’ immediate focus is to protect cashflow. One of the biggest challenges for marketers right now is adapting to dramatically new consumer buying patterns which differ radically by category. We all know that brands which are able to still invest during a downturn have often been proven to bounce back stronger, however these are unprecedented times. That said, I believe all brands need to retain a consistent connection with consumers which is honest, authentic and meaningful. John West is no different – despite all of the challenges today, we’re still totally focused on supportive engagement with our consumers.”

Calum Smeaton, CEO, TVSquared, said: “The report shows the flux the advertising industry is experiencing as some campaigns ‘go dark’ and budgets are reviewed. With brands looking to optimise costs, there’s a clear need to understand where and how audiences are now spending their time with media. More specifically, TV audiences across all platforms – linear and digital – have increased, but marketers need the tools to take full advantage of those new opportunities. For many, the missing link is attribution. To ensure the longevity of reduced advertising budgets, every single campaign must be bought, sold and measured based on data-driven insights. This will enable marketers to not only prove campaign ROI, but continuously measure creatives, programmes, days, etc. to optimise buys that deliver the best possible audience response. While the report anticipates a shrink in ad spend this year and recovery in 2021, brands must consider if ‘going dark’ on TV is worth the knock-on-effect to digital and social efforts, as well as brand awareness – aka the halo effect TV provides. It is more necessary than ever for brands to make sure they’re visible to audiences and maintain meaningful connections with them.”

Maria Cadbury, Managing Director, Persollo, said:”We are noticing a high increase in social usage and a halt in branded content, as production teams and consumers stay inside. Conversely, there is a huge spike in the update of influencer marketing, as influencers create compelling brand content from their homes. The real success for influencer marketing comes with advanced social eCommerce technology – which is driving sales and AI-driven analytics technology – to give brands the brand safety and fraud transparency stamp for reassurance. Now at this crisis time of Covid-19, more brands are testing new solutions and incorporating eCommerce technology into their influencer shoppable strategy, which is driving sales”.

Ian Lowe, VP of Marketing, Crownpeak, said:“While these results aren’t surprising, what we’ve noticed recently is that the current pace of change is amazing, with business perceptions on the pandemic – its short and long-term impacts – adjusting every week. This report highlights that budget cuts are already underway, and with most CMOs predicting further severe reductions over the next twelve months, everyone is creating cost-cutting scenarios, but the speed of marketing itself has seen huge increases. For example, our customers are editing content up to nine times the normal daily rate so we’re expecting a marketing mindset of “do more with less” to pivot from aspirational, to essential.”

Ivan Ivanov, COO, PubGalaxy, said: “As marketing budgets and ad spend are hit by the immediate impact of Covid-19, we’re already seeing the effects on digital publishers. For one-dimensional websites these will vary according to the verticals they operate within. While some might be currently experiencing a higher rate of ad campaigns in sectors such as gaming, tech and electronics, others will be suffering from reduced ad spend in tourism, hospitality and leisure, for example. However, success in 2020 for all-size publishers is going to depend on their ability to keep adapting advertising offerings to meet shifting needs. With ad revenue fluctuating, publishers need to access more stable sources; reconfiguring their programmatic setup can help. There are channels — that operate on result-based marketing — that can be a safer option for maximising buyer returns during difficult times and by fine-tuning their supply to match demand-side trends, publishers can continue to find monetisation options to support them through the next stage of the crisis.”

Fran Cowan, VP marketing, International Advertising Association, UK, said: “Understandably, this report presents a negative picture of the industry, the data was gathered at a time when events were still unfolding and we don’t expect to see the full effects of the situation until this quarter. The causes of this downturn come from unprecedented global circumstances, yet we can apply learnings from previous times of economic crisis, and know companies that maintain some marketing efforts will most likely reap the rewards and rebound quicker. However, it’s important to do this in a controlled way. Now is the time to carefully consider where marketing budget is best spent, to look after employees, partners and suppliers as well as protect brand images. Luckily in the UK, we have an industry that pulls together during these times. We’ve already seen some great collaborative thinking and initiatives that support the notion of ‘advertising for good’.”

Michael Nevins, CMO, Smart AdServer, said: “The current crisis means companies have direct control over money going out, but not coming in. Many have therefore paused marketing spend to focus on what will generate revenue tomorrow, thinking only of the short-term, rather than 6-months down the line. This is very much a similar situation to what the industry saw after the 2008 stock market crash, during which the entire ad market declined by 13%. However, unlike with the financial crash, the industry today is better prepared for recovery – the IPA forecasts a +1.0% rise in ad spend following the crisis – and has a positive means by which to do so. Far from being a time to pause media spend, the industry must work to champion the independent publishers who uphold the media ecosystem and provide access to critical public service news. And part of that is a responsibility for advertisers to support quality British journalism at this time.”

Charlie Johnson, VP, UK & Ireland, Digital Element, said: “The optimism and adaptability of the industry at this unprecedented time has been impressive. While a downturn was inevitable, the strong expectations for a quick recovery after the pandemic is encouraging and testament to the spirit of the sector we work in. Business leaders are realising how adaptable their employees are in this new era of remote working and embracing the contact-free means to develop business, moving seamlessly to digital and virtual events, as an example. As the industry evolves through this uncertain time and begins to prepare for a positive future, the ability of both teams and the tools they use day-to-day to adapt to changing business needs will continue to be paramount to success. As we work to weather this storm and ride through the pandemic, the solutions available to marketers are being scrutinised more than ever, due to the need to drive efficiency and accuracy. It is those multi-purpose, reliable solutions that give businesses the foundation on which to do great work that will gain loyal customers now and most importantly support long-term results.”

Nick Morley, EMEA MD, Integral Ad Science (IAS), said: “The Q1 2020 IPA Bellwether Report indicates an unsurprising downturn due to marketing budget cuts sparked by COVID-19. As an industry, we have a responsibility to support marketers in every sense: with empathy, support, thought leadership, data, guidance, and real solutions to problems. It was positive to see the optimism within the IPA report regarding the UK economy, however, with many expecting a full recovery during the coming financial year. Now really is the time to pull together, work directly with industry bodies and governments to find solutions at a time where technology can be used for the greater good. Throughout this contextually sensitive situation, brand safety and suitability remain at the forefront of marketers’ minds. Instead of a broad application of keyword blocking, at IAS we are advising a more pragmatic approach, with the consideration that not all COVID-19 content should be deemed unsuitable. Given the vital role of trusted content in keeping the public safe and informed, we are advising thoughtful consideration to how advertisers can support quality media outlets. For publishers, leveraging technology that provides necessary page-level analysis of context and sentiment can minimise media wastage and maximise yield amid increased site traffic, ensuring that ads are matched and less likely to be blocked.”

James Draper, CEO, Bidstack, said: “The report provides an unsurprising outlook for the media industry, as marketing budgets shrink and brands shy away from the limelight. However, we can be optimistic for the economic recovery predicted for 2021 and, in the interim, look to the sectors experiencing an influx of new audiences as people stay indoors. Gaming is an example of a sector thriving among the chaos. This has been recognised by the UK government – who is collaborating with developers, such as Bidstack’s partners Codemasters to reinforce its ‘Stay Home Save Lives’ messaging during the COVID-19 pandemic in some of the most popular video games (for example DiRT Rally 2.0). Gaming provides a bright spot in these bleak times for brands looking to connect with this evolving audience, in an environment rich with real-world advertising opportunities.”

Alexander Igelsböck, CEO, Adverity, sad: “From Brexit to Coronavirus, so much has changed since Q4 2019. Clearly, 2020 is going to be one of the most challenging years as marketers seek to maximise their budgets, many of which are currently restricted. With market research and event marketing budgets experiencing the largest impact in Q1, the value of efficient marketing tools and data-driven approaches to advertising will be more critical than ever. Every marketing pound is under scrutiny and expected to work harder. The global impact is impossible to avoid, but during times of change comes demand for increased innovation and efficiencies. While we have already seen evidence that creativity supported by data-driven insights does not have to be stifled due to reduced budgets, it is hugely encouraging to see evidence that industry sentiment for a quick recovery is strong. Understandably, the short-term outlook may provoke caution among advertisers, but looking further ahead is critical and we must all be planning for the now, the then, and the next.”

Niki Stoker, COO, A Million Ads, said: “The data reflects the impact of a once in a lifetime pandemic, but obscures the underlying strength of some of the advertising channels and their future value. Whilst audio investment was revised downward by a net -6.9%, this disguises the fact almost three quarters of audio budgets (71.8%) are expected to remain stable for the financial year. Even in uncertain times there is confidence in this channel to reach people who are increasingly relying on digital radio and podcasts at home to get their news and entertainment. We only expect to see this confidence grow as we emerge from lockdown”

Phil Acton, UK Country Manager, Adform, said: “The impact of the current crisis is being felt across the board and this report evidences the impact to marketing budgets. As a company founded shortly after the 2001 Dot-com bubble burst and a business that navigated the 2008 crisis, we know that rapid and decisive action is needed to ensure the predicted recovery in 2021 is a reality. If an aircraft encounters turbulence it is your first responsibility to secure your own mask and then look after those travelling with you. So, as an industry, we have to look after our own people and strike a balance between our employees’ needs and well-being, with the practicalities of navigating this crisis for the business. What we have seen is brands, agencies, and publishers facing rapidly changing market situations, which call for additional help. Some examples we have come across as industry leaders include internet traffic being through the roof, engagement up, but prices are down. Our clients need enhanced support and effective service teams to weather this storm, which is why timely knowledge, insights, and guidance are more important now than ever. Adform is extremely proud of how its employees have risen to the occasion with a sense of investment and commitment, and while significant challenges await the industry – with the report anticipating a -13.7% decline in expenditure before the rise begins in 2021 – Adform is keen to move Forward. Together.”

Sebastian Gray, Co-founder and SVP, Dugout, said: “The reduction in ad spend is a natural reaction to recent events, and an unavoidable one in many industries such as travel and hospitality. Aside from budgets naturally being paused, a large part of the hesitation in Q1 2020 was down to blanket keyword blocking that avoided association with coronavirus-related media entirely, making it hard for advertisers to safely reach their target audience. As the year goes on, advertisers and publishers need to work more closely, identifying ways to make the most of high search volumes and the consumers desire to be entertained and stay connected to the outside world. This can be achieved through targeting premium placements with confidence, with video suppliers and publishers supporting this approach. For example, sponsored editorials offering advice on how to stay fit and healthy during lockdown and contextually relevant ad placements within video content that take advantage of consumers increased online activity.”

David Fletcher, Chief Data Office, Wavemaker, said: “It’s not going to shock anyone that the short-term outlook is extremely challenging. There is however longer-term optimism and while we will be dealing with the fallout from Covid-19 for some time to come consumer confidence will ultimately return and with-it marketing budgets will start to bounce back. There has been lots of talk about advertising through a downturn however, the word that we see most frequently used to describe the current situation is unprecedented. We are dealing with a global emergency and not an economic downturn and the old playbooks no longer apply wholesale.

“The current situation is far more complex than an economic downturn. The brands that are setting themselves up for success are the ones that are finding a tone that resonates with the public and have remained committed to delivering for their customers. Stronger brands weather tough times better than weaker brands. Those that emerge strongest from this period will be those who demonstrated the very best of what they could be. The ones who not only stood up, but stood out.”

Tom Byrne, SVP Agency Services, EMEA, Merkle, said: “The results are no surprise given the massive disruption that COVID-19 is wreaking across the economy. In the short term, many businesses are in survival mode in order to protect jobs and keep themselves afloat. For others, the internal process that would have meant digital transformation that would taken months or even years to achieve are falling away laying the foundations for dramatic organisational innovation. The results also suggest that there is optimism that we will start to return to a semblance of normality later this year. Many businesses will be using this period of enforced pause to use deep analytics to re-evaluate large swathes of their strategy and develop more robust ad and martech foundations. Many are already turning their attention to how their business will be shaped when emerge from the pandemic. The use of data to properly inform new strategies and business plans and to drive a host of tactical decisions across the business at pace will be absolutely critical. Today’s business decisions will be judged and scrutinised in years to come so they shouldn’t be viewed as a short-term fix, but a long-term solution.”

Henk Campher Vice President Corporate Marketing at Hootsuite, said: “Although budget declines are in line with what is happening in the economy, that doesn’t mean an abandonment of marketing. P&G for example has ramped up spend during the COVID crisis and judging from their recent financial results the gamble has paid off – but you don’t need to be the world’s biggest advertiser to see results. The brands that will come out of this crisis strongest will be the ones that quickly adapt digital marketing strategies and make the most of owned channels. Marketing is ultimately about building relationships and that doesn’t always need to involve big budgets. Something as simple as getting communication right over social media can build and maintain loyalty amongst customers more effectively than fancy ad campaigns. For example, Hootsuite data continues to show a more than 30% increase in the use of Inbox, a tool that manages 1:1 messaging and customer interactions. This shows a real opportunity for brands to both engage with their loyal social media followers on thier public channels, and build one-on-one long lasting relationships with consumers they otherwise may have struggled to reach on their private channels. Social is returning to the basics in terms of what’s important — authentic interactions. Budgets may have been reduced but by reallocating resources, it doesn’t have to impact brands’ relationships with customers.”

Anna Jaycocks, Marketing Director for Blackhawk Network, said: “With both marketing and essentially people’s budgets continuing to take a hit, marketers are currently having to totally rethink their acquisition strategy. It’s not going to be just one ad they’ve seen on social media or a well-worded PPC click that will be enough to make customers part with their cash. Consumers are more sensitive than ever to price and brand advocacy is going to play a huge part in this. The Aberdeen Group found that in normal circumstances, reward-based incentive programmes can outperform programmes without rewards by 30%. So imagine the impact they can have when people are actively looking to be rewarded or save some money. A solid loyalty program that rewards customers for their purchases or a reward as a nice added extra for choosing to switch could make a huge difference to a consumer, especially one who may be struggling financially. In times of hardship, consumers remember the brands that supported them.”

Tom Castley, VP of UK at Outreach (sales engagement platform), said: “The COVID-19 pandemic is having serious ramifications for the economy and business confidence, with UK marketing budgets unable to remain immune to decreases. With businesses needing to be more efficient in their spend, marketers need to ensure their programmes are delivering results. Marketing has always been about opening the funnel wide to attract as many leads as possible, then passing them on to sales to qualify and close deals. Now more so than ever, both functions need to work more closely to ensure campaigns are reaching the right audiences and are helping to build a robust pipeline of leads. Having the right tools, such as sales engagement platforms, to enable this collaboration will be a key part in providing an effective feedback loop along the funnel, enabling marketers to quickly pivot their activities where needed. This can only be achieved by throwing out the cliched disjoint between the sales and marketing functions.”

Paps Shaikh, Commercial Director – EMEA at Nextdoor comments: “The latest IPA Bellwether report is a stark reminder of the impact Covid-19 is having on the ecosystem. It’s not surprising to see marketing activity being turned off during periods of increased uncertainty. However, it’s really important to get a balance between switching it off entirely and still communicating with consumers at a time when they need reassurance the most. It will be the brands that use marketing strategies to do good and express a purpose who will stay front of mind with consumers when normality resumes. I expect these findings to be a sign of what’s still to come and there will be casualties along the way. However, there are some sectors which are thriving during this crisis. For these brands, marketing at this level has been uncharted territory, but as they unlock their full potential, and as others start to ease the tap back on, there is no reason to believe that marketing spend won’t bounce back when the lockdown eases.”

Amit Kotecha, Marketing Director, Permutive comments: “Optimism beyond the pessimism is the underlying message of the latest IPA Bellwether report. We may not have seen total marketing budgets decline this fast since the global financial crisis, but these are extraordinary times. Coronavirus has put paid to a lot of activity this quarter, but many marketers expect it to pick up over the course of the year: ad spend might be down in 2020 but most expect recovery into 2021. Whilst we understand the rush to cut budgets in the confusion of the immediate situation, history shows that those who spend through the bad times are better placed when better times return – as the IPA itself acknowledged last week through an ad campaign in the Financial Times. In fact, reaching your audience through trusted, premium environments such as the FT.com and its more consumer-focused counterparts is probably more important and effective than ever. Now is the right time to support them – for the future good health of your business and theirs.”

Ben Little, Founder and Director at Fearlessly Frank comments: “The latest IPA Bellwether report mirrors the findings of many other surveys of market sentiment, where we are seeing more uncertainty and more confusion than ever before. The current popular understanding of economies, markets and marketing is simply inadequate to accommodate the scale of the change engulfing us. While it is hard to plan against years of unpredictability and uncertainty, we must face the fact that there will be no ‘return to normal’, meaning the current model of marketing will no longer be fit for purpose. Instead, zero-based budgeting will be the only way to run a business, which has profound implications for any marketing services business. This will accelerate the shift towards the gig economy and in-housing for most marketing, and exacerbate the urgent need to build a value-adding strategic relationship with all clients. Critical thinking, originality and objective evaluation of behavioural data and economic research will be the characteristics of success. Anyone not willing to embrace these approaches are unlikely to survive.”

Paul Frampton, President, Europe at Control V. Exposed, said: “Today’s IPA Bellwether does not make for good reading– but nor, following the outbreak of the coronavirus pandemic this quarter, did any of us expect it to. The report signals that marketers believe budgets will pick up later this year and recover in 2021, but don’t hold your breath. My personal view is that Q2 will be a tough ride for almost everyone, and Q3 only marginally better. It will take until Q4 for things to approach a semblance of normality and we are planning for recovery to be gradual into 2021, as uncertainty, particularly in sectors such as hospitality, travel and physical retail, will remain for some time. This is a genuinely unprecedented global event with no fixed end date – even our most talented experts don’t know what will happen next. It’s time to take stock and reflect, for marketers to prepare themselves for future challenges and opportunities. Is your marketing model the right one? Are you investing in the right channels? Is enough of your spend going to working media? Do you have enough control over your data and tech capability? The raging debate around in-housing will likely lead to splintering from brands – some will double down so they can react faster and more meaningfully to existing customers and others will look for more flexible out-sourced service agreements. If you are willing and able to invest right now, there are opportunities to be had however. We’re seeing a significant drop in digital CPMs (as much as 25%); reduced competition and improved pricing dynamics – making it a good time to spend and steal share of voice from competitors.”